Delta Slashes Earnings Guidance, Cites Sinking Consumer Confidence

Delta Air Lines has long led the US airline industry when it comes to profitability, and in recent years, it seems like there have been no signs of the good times ending. Well, that’s finally starting to change, and some cracks are forming…

Delta Air Lines has long led the US airline industry when it comes to profitability, and in recent years, it seems like there have been no signs of the good times ending. Well, that’s finally starting to change, and some cracks are forming…

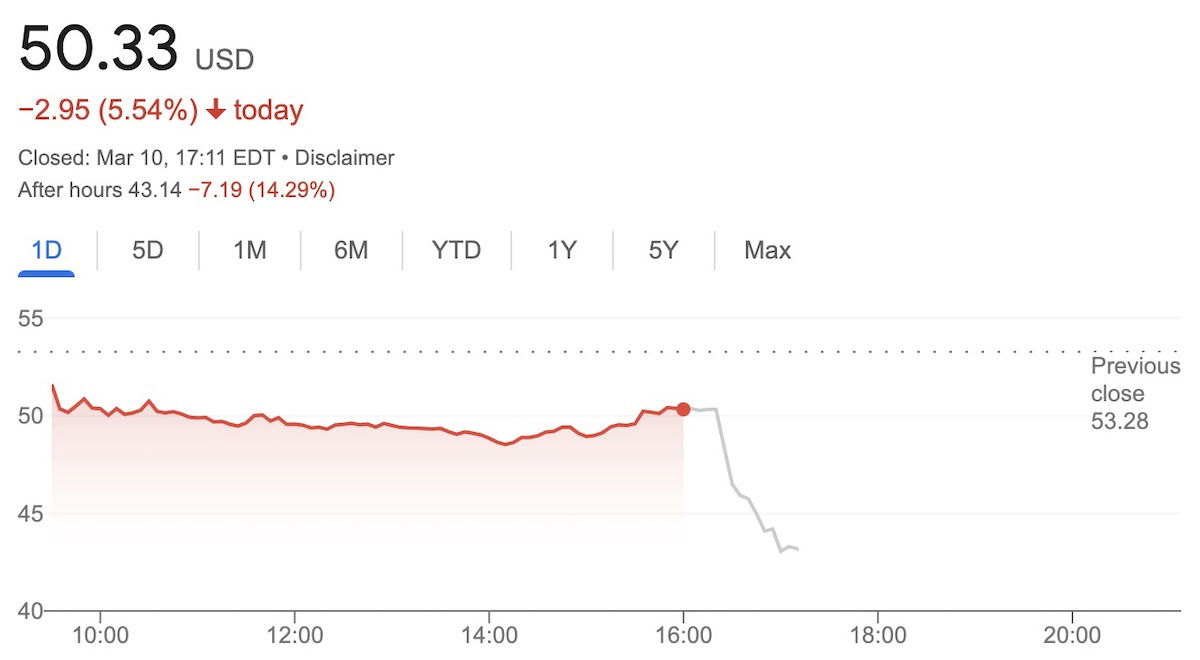

Delta cuts earnings guidance, stock tanks

Delta has just slashed its earnings and revenue guidance for the first quarter of 2025, ahead of a Tuesday morning presentation at the JP Morgan Industrials Conference. The reason?

“The outlook has been impacted by the recent reduction in consumer and corporate confidence caused by increased macro uncertainty, driving softness in Domestic demand.”

With this updated guidance, Delta has cut its first quarter revenue growth forecast to 3-4%, less than half its earlier forecast of 7-9%. Furthermore, the airline has adjusted its forecast for adjusted earnings to 30-50 cents per share, compared to the earlier forecast of $1 per share.

With this update, the airline expects a first quarter operating margin of 4-5%, compared to the earlier forecast of 6-8%. However, the airline notes that “premium, international and loyalty revenue growth trends are consistent with expectations and reflect the resilience of Delta’s diversified revenue base.”

Delta’s stock is tanking in after hours trading, and as of the time of this post, shares are down over 14% (and they’ve already dropped around 25% over the past month).

As you’d expect, other airlines are impacted as well, since this has implications for the entire industry. In particular, United is viewed as Delta’s biggest competitor nowadays, and the carrier’s shares are down 11%.

Is this a bump in the road, or more serious than that?

I’ll let everyone decide for themselves why consumer confidence might be sinking. I mean, I have some theories, but we live in a world where everyone has their own reality, so I don’t want to impose my beliefs on others.

Airlines like Delta and United have been incredibly resilient in recent years. Despite the drop in business travel, the airlines have seen strong demand for premium, international, and leisure travel, plus have had strong revenue for their loyalty programs, and that’s why they’ve been reporting record revenue and profits. There has basically been no sign of that slowing down… until now.

So one wonders, is this just a temporary bump in the road due to [insert what you think is causing this], or is this the start of a bad time for the airline industry?

The airline industry has of course dealt with massively rising costs (especially with labor), so they need a lot more revenue to even cover their costs. In the United States, even the most profitable airlines basically just break even on flying passengers (since the cost per air seat mile and revenue per air seat mile are roughly comparable), and make most of their profits through other means, like their loyalty programs.

There’s only so much upside with loyalty programs, so if consumer confidence continues to decrease, it’ll be even worse news for other airlines, which don’t have loyalty programs that are quite as lucrative.

Bottom line

Delta has updated its guidance for the first quarter of 2025, and it’s bad news. Projected revenue growth and earnings have both been more than slashed in half, which isn’t good. The airline blames this on a reduction in consumer and corporate confidence, caused by increased macro uncertainty.

What do you make of Delta’s updated earnings guidance, and how do you see this playing out for the industry?