How To Apply For Amex Business Cards & Get Approved

American Express has a great portfolio of small business cards, and the cards often have large welcome offers. For that matter, a lot of card issuers have been focused on small business cards over the past several years, and you’ll often find that they have better welcome bonuses and benefits than personal cards.

American Express has a great portfolio of small business cards, and the cards often have large welcome offers. For that matter, a lot of card issuers have been focused on small business cards over the past several years, and you’ll often find that they have better welcome bonuses and benefits than personal cards.

For those who may not be familiar with the process of applying for business cards, in this post I want to talk about Amex small business cards. What are the popular Amex business cards, what are the rules for getting approved, can you apply with a sole proprietorship, etc.?

What are Amex’s best business cards, and why?

American Express has a variety of lucrative business cards. Some earn Membership Rewards points, while others are co-branded cards that can earn you valuable airline or hotel rewards.

If you’re looking to earn Membership Rewards points, consider one of these cards:

- The Business Platinum Card® from American Express (review) — the card offers big perks that can make it worth holding onto

- The American Express® Business Gold Card (review) — the card offers excellent bonus categories and great perks

- The Blue Business® Plus Credit Card from American Express (review) — the card has a lucrative rewards structure

If you’re looking to earn hotel rewards, consider one of these cards:

- Hilton Honors American Express Business Card (review) — the card offers elite status and other perks that can make it worthwhile

- Marriott Bonvoy Business® American Express® Card (review) — the card offers an annual free night award, bonus elite nights, and more

If you’re looking to earn airline rewards, consider one of these cards:

- Delta SkyMiles® Reserve Business American Express Card (review) — the card is for Delta super users who are loyal, and want to spend their way to status

- Delta SkyMiles® Platinum Business American Express Card (review) — the card is good for a relatively frequent Delta flyer, who values perks

- Delta SkyMiles® Gold Business American Express Card (review) — the card is best for the casual Delta flyer, who wants basic benefits

What are the restrictions on applying for Amex business cards?

Amex’s consistent rules regarding getting approved for business cards are as follows:

- Welcome offers are generally “once in a lifetime,” so you’re typically not eligible for the welcome offer on a card if you currently have it, or have received a welcome offer on that card in the past; some cards also have “family” restrictions, whereby you’re not eligible for a welcome offer if you have a card in the same family

- Amex typically limits cardmembers to having five credit cards at a given point, including personal and business cards; however, this only applies to traditional credit cards with preset spending limits, so cards like The Business Platinum Card® from American Express and The American Express® Business Gold Card don’t count toward that limit

- Amex will sometimes decide that people aren’t eligible for welcome offers on cards despite otherwise following the rules, and in those cases, you should get a pop-up during the application process warning you of this

Are Amex business cards easy to get approved for?

There’s not really published data on how hard various cards are to get approved for. That being said, anecdotally speaking, I find Amex business cards to be among the easiest to get approved for. That’s true compared to other business cards, and even compared to many personal cards. That doesn’t just apply for people applying as corporations, but also for sole proprietorships.

Anecdotally, I find that the Amex business cards that aren’t credit cards, like The Business Platinum Card® from American Express and The American Express® Business Gold Card, are actually the easiest to get approved for.

Here’s what makes it even better, though. Not only are Amex business cards easy to get approved for, but they’re also among the lowest risk cards you can apply for.

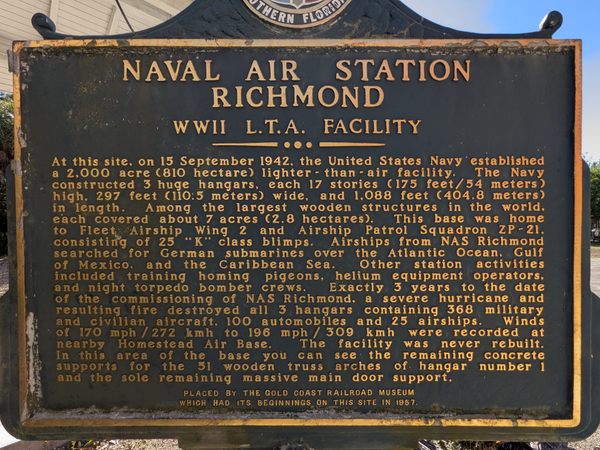

Getting denied for a card isn’t a big deal, but it’s even less big of a deal with Amex. When you go to the application page for a business card, you should see a note stating “Know if you’re approved with no personal credit score impact.”

As you’ll see explained there, you’ll get a decision about your approval without any impact on your personal credit score. So in the event you’re not approved for the card, it has absolutely no impact on your personal credit score. This is as risk-free as card applications come.

Can you earn Amex business card welcome offers more than once?

As mentioned above, Amex card welcome offers are generally “once in a lifetime,” meaning you can only earn the offer on a card once. However, there are a couple of caveats with that, as the reality is a bit nuanced.

First of all, there’s a debate as to how a “lifetime” is defined. Anecdotally, some people report being eligible for a welcome offer again roughly seven years after they’ve last had a particular card. This isn’t a published policy, but some people report success with that. Keep in mind that thanks to Amex’s pop-up warning about welcome offers, you’ll generally be warned if you’re not eligible for an offer.

Second of all, Amex frequently targets members for business card applications, even if they wouldn’t otherwise be eligible. These applications generally have “no lifetime language” in the terms, meaning there’s nothing in the terms stating you can’t qualify for a welcome offer again.

I’ve been targeted for many of these cards over the years, including for cards I already have, so clearly there are some exceptions. Let me emphasize this only applies if you’re targeted for a card, and if the terms don’t have any language around not earning a welcome offer if you have or have had a card.

Can you apply for Amex business cards without a business?

You need some sort of a business to get approved for a business card, but not necessarily in the way that many people would assume. You don’t need to have a corporation to pick up a business credit card, but rather, a sole proprietorship qualifies as well.

A sole proprietorship is the most basic form of a business, where it’s owned and run by one person, and isn’t incorporated. The owner has unlimited liability, and the business has no legal existence, separate from the owner. The owner reports the business’ income on their personal tax return, and pays federal and state income tax on profits.

Now, I’m obviously not hear to advise as to what kind of a business someone should set up (you should talk to a tax professional about that), but in most places there’s literally no barrier to having a sole proprietorship, as it doesn’t even require registering in any official capacity.

For many people, a side hustle could very well be considered a sole proprietorship, whether you have a property you rent out, you do consulting, you’re a freelance writer, or whatever. There’s value to being able to separate your business expenses from your personal expenses, and of course the very lucrative business cards that we see don’t hurt either.

How should you fill out an Amex business card application?

Those who already have business credit cards are probably familiar with the application process, but for those who aren’t, let’s talk about what you need to know.

It can be intimidating to apply for your first business card, though even if you’re a small business or sole proprietorship, you should be eligible. When applying for an Amex business card, you’ll be asked the following questions:

- Legal Business Name

- Business Address & Phone Number

- Industry Type

- Company Structure

- Years In Business

- Number Of Employees

- Annual Business Revenue

- Estimated Monthly Spend

- Federal Tax ID

If you’re a sole proprietorship, how should you approach this? First of all, and most importantly, answer everything truthfully. I think the concern that a lot of people have is that they think they need an incorporated business, a separate office, etc., in order to be considered for a business card. That’s not the case:

- You can use your name as your legal business name

- The business address and phone number can be the same as your personal address and phone number

- You can select “other” as your industry type, if the options don’t otherwise describe your business

- If you’re a sole proprietorship, you can select that as your company structure

- In terms of years in business, there’s no shame in saying it has been less than a year, one to two years, etc.

- In terms of the number of employees, saying just one is perfectly fine

- For the federal tax ID you can put your social security number

While a lot of people are intimidated by applying for their first business card, I think most are pleasantly surprised at the results. Best of all, keep in mind that with Amex you’re generally warned if you won’t be approved for a card without an impact on your personal credit, so there really is limited downside.

Bottom line

American Express business cards can be very beneficial additions to your wallet, so hopefully this is useful for anyone who hasn’t yet applied for an Amex business card. Even if you’re not someone who has applied for Amex business cards in the past, you may be pleasantly surprised by the results.

At the moment there are some particularly good offers on Amex business cards, so this is a great time to take advantage of one of these offers. In particular, you can’t go wrong with a card like The Business Platinum Card® from American Express or The American Express® Business Gold Card.

What has your experience been applying for Amex business cards?

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)