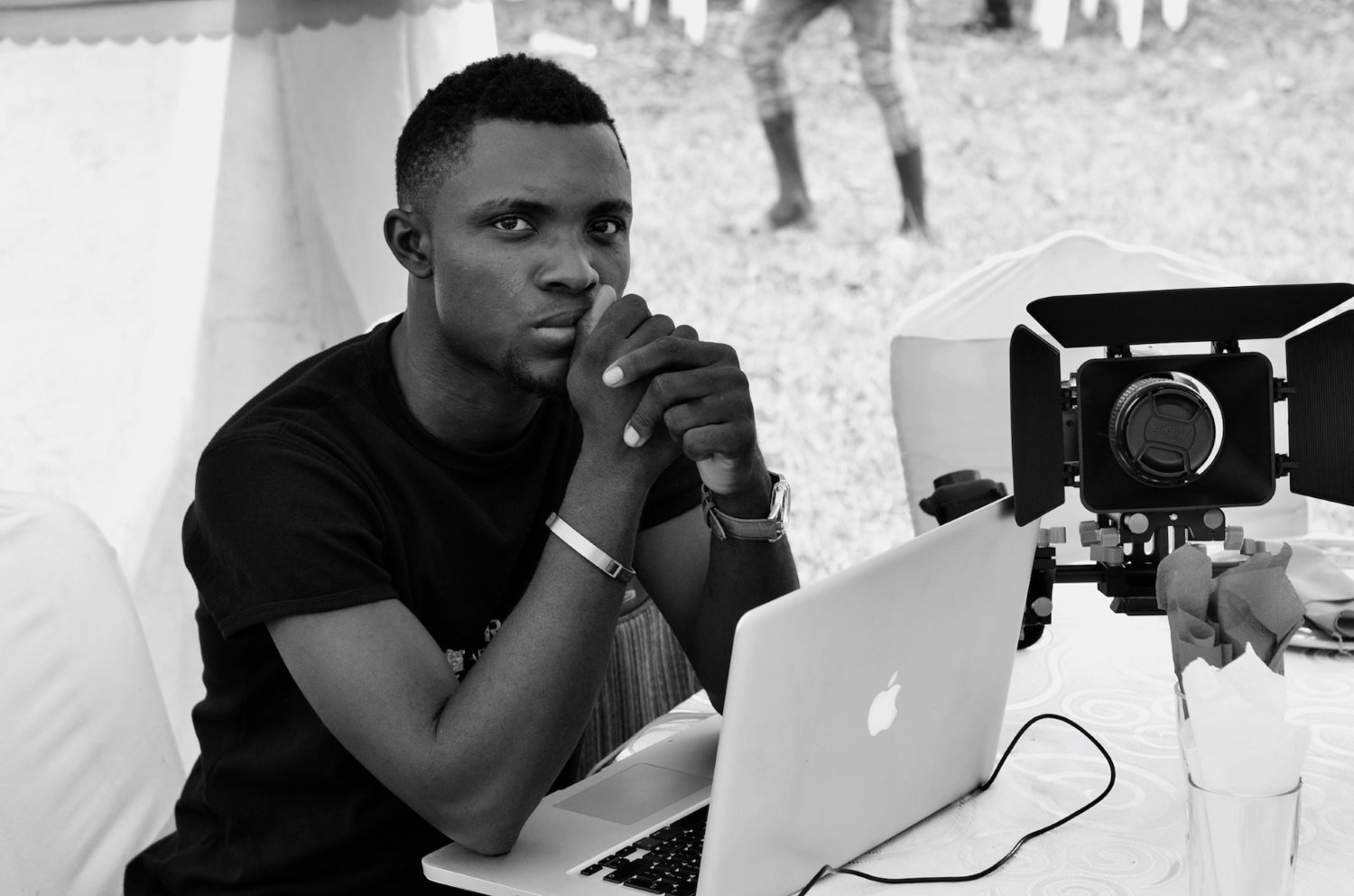

My Emirates Credit Card Application Approval Experience

I just submitted my latest credit card application, and want to report back on my experience (it’s good news!).

I just submitted my latest credit card application, and want to report back on my experience (it’s good news!).

Why I picked up Emirates’ premium credit card

I’m a big fan of Emirates first class, and Emirates Skywards recently implemented a new policy when it comes to redeeming the program’s miles for first class travel. Specifically, you now need Skywards elite status in order to be eligible to redeem for first class.

Admittedly there are some workarounds — you can still upgrade from business class to first class without status, select partner programs still have access to this first class award space, etc. That being said, there’s not that much of a barrier to actually getting Emirates status, so I figured I’d go for it.

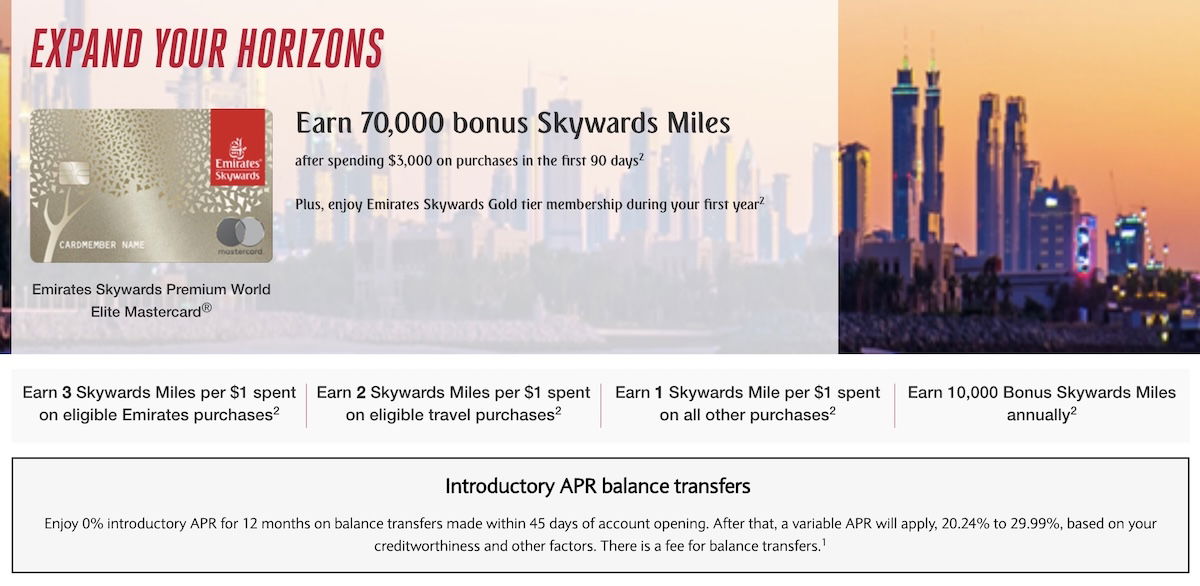

Specifically, Barclays issues two co-branded Emirates Skywards credit cards in the United States. I decided to apply for the $499 annual fee Emirates Skywards Premium World Elite Mastercard. Am I happy about picking up another card with such a high annual fee? Not really. But here’s how I went about justifying this:

- The card is currently offering an elevated welcome bonus of 70,000 Skywards miles upon completing minimum spending, so that’s a pretty good bonus

- The card offers Skywards Gold status for the first year, and Skywards Silver status in subsequent years with no spending requirement (alternatively, you can spend $40,000 per year to maintain Gold status)

- An often overlooked perk is that with the Marriott & Emirates Your World Rewards partnership, Emirates elite members earn one mile per dollar spent with Marriott; so having Emirates elite status will earn me bonus Emirates miles for my Marriott stays, which is worth something

- The card offers some other potentially valuable perks, like a Priority Pass membership, including for authorized users

Anyway, I’m not sure what my long term strategy is here. We’ll see if I pay the annual fee on an ongoing basis, downgrade to the more basic $99 annual fee card, or cancel it. Regardless, the card is worth applying for (in my situation), as I do value being able to redeem for Emirates first class.

My Emirates credit card approval experience

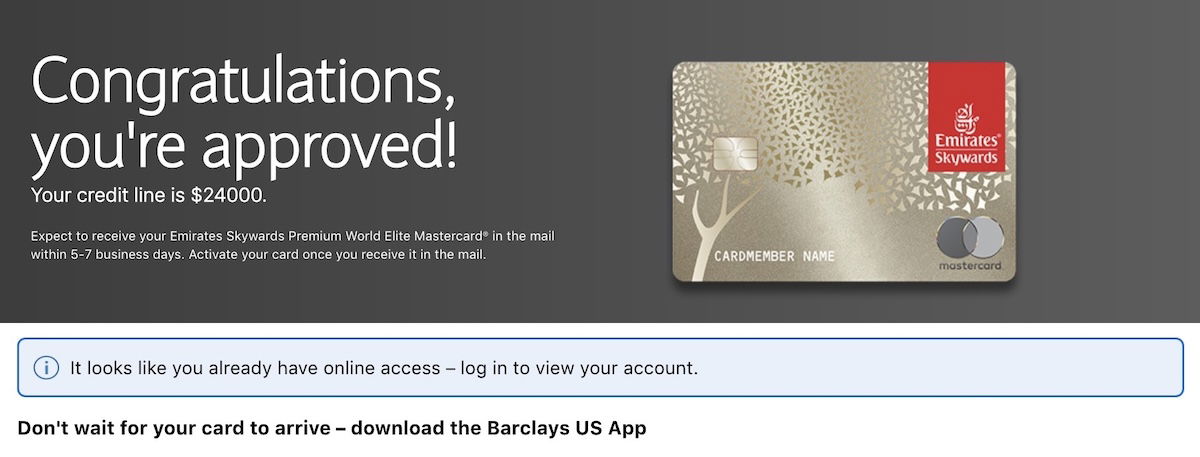

It has been some time since I’ve applied for a Barclays credit card, so I submitted my application this morning. The application was straightforward, and I was delighted to find that I was instantly approved, and I even had the option of getting the new card number right away.

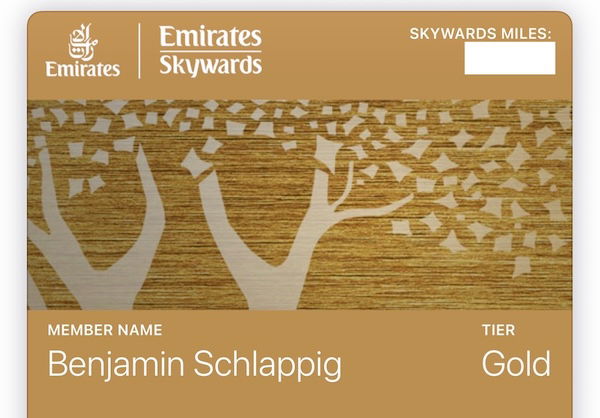

I was curious to see how long after approval it would take before my Emirates Skywards status is updated. To my surprise, my status was upgraded within hours, and my Skywards account already reflects my Gold status — score!

For those curious about the rules surrounding eligibility for the welcome bonus, the application terms state that “you may not be eligible for this offer if you currently have or previously had an account with us in this program.”

Obviously that’s not very specific. Beyond that, Barclays generally has pretty inconsistent rules surrounding approval. For example, there’s often the 24-month rule, whereby you’re not eligible for a welcome bonus on a card, if you’ve received a bonus on that card within the past 24 months. I can’t speak as to whether or not that applies here (if anyone knows, please let me know!).

Bottom line

I decided to apply for Emirates’ premium credit card, and was instantly approved. Not only that, but my Emirates elite status was upgraded within hours of approval, so that’s pretty awesome. I’m not sure what my long term strategy will be, but I’ll take the 70,000 bonus miles and Emirates Skywards Gold status for a year, and we’ll go from there.

Hey, I get Emirates’ new restrictions on award travel are working in some way to increase engagement, as it’s what it took for me to apply for the credit card!

Has anyone else picked up an Emirates credit card in recent times? If so, what was your experience like?

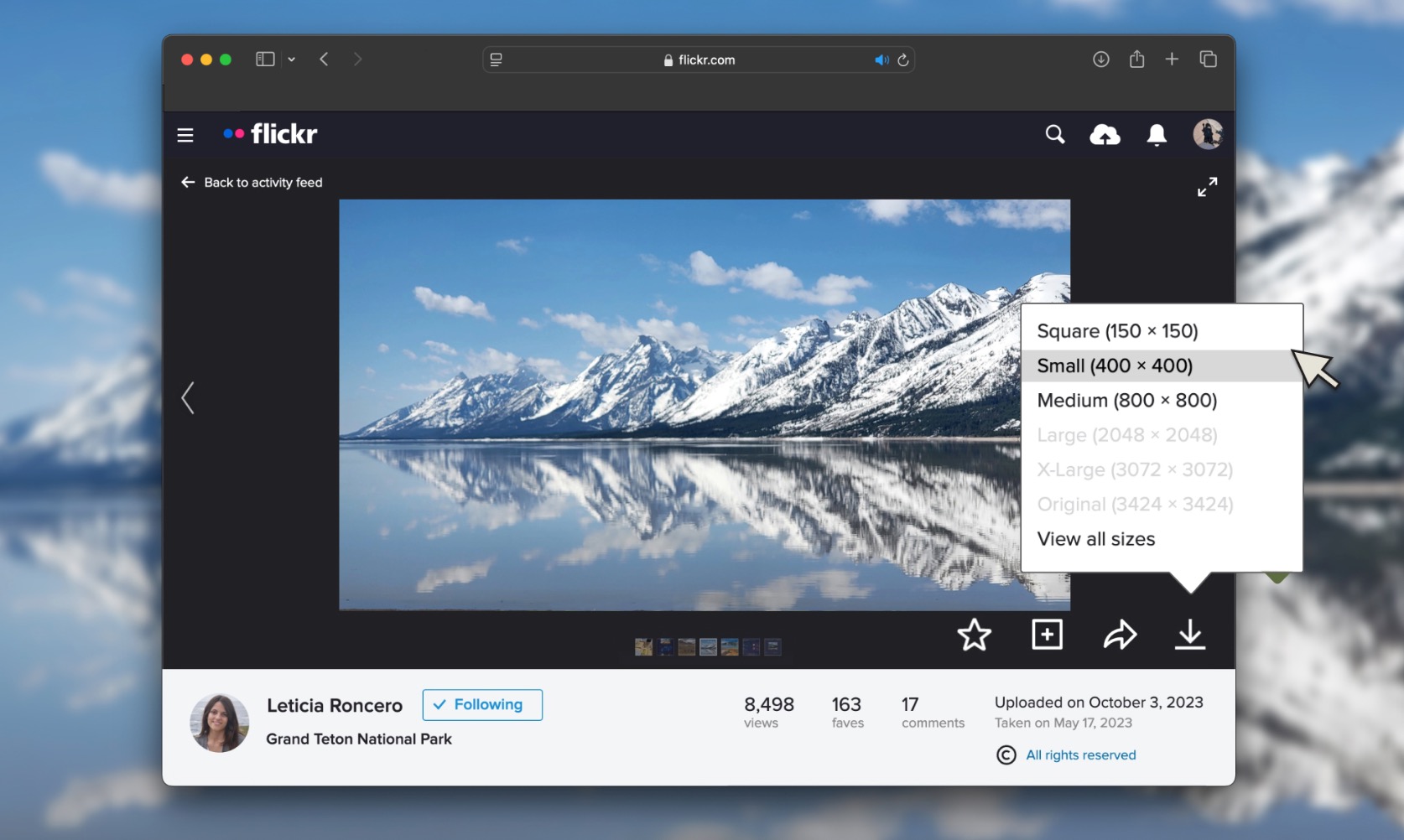

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)