How to transfer Capital One miles to airline and hotel partners

Editor’s note: This is a recurring post, regularly updated with new information. Since adding transfer partners to its travel rewards cards in 2018, Capital One has become a quality transferable rewards program with 15-plus transfer partners. Most transfers are processed at a 1:1 transfer ratio, meaning that 1,000 Capital One miles are worth 1,000 airline …

Editor’s note: This is a recurring post, regularly updated with new information.

Since adding transfer partners to its travel rewards cards in 2018, Capital One has become a quality transferable rewards program with 15-plus transfer partners. Most transfers are processed at a 1:1 transfer ratio, meaning that 1,000 Capital One miles are worth 1,000 airline miles or hotel points with most programs.

This guide will show you how to maximize Capital One miles for flights and hotel stays through the bank’s various transfer partners.

Related: Should you transfer Capital One miles to partners or redeem directly for travel?

How to earn Capital One miles

You can earn Capital One miles with six credit cards, which we’ve listed below along with their current welcome offers. Read our guide to the best Capital One credit cards for more information about your options.

- Capital One Venture Rewards Credit Card: Earn 75,000 bonus miles after spending $4,000 on purchases within the first three months from account opening. $95 annual fee.

- Capital One Venture X Rewards Credit Card: Earn 75,000 bonus miles after spending $4,000 on purchases within the first three months from account opening. $395 annual fee.

- Capital One VentureOne Rewards Credit Card: Earn 20,000 bonus miles after spending $500 within the first three months from account opening. No annual fee.

- Capital One Venture X Business: Earn 150,000 bonus miles after spending $30,000 in the first three months from account opening. Plus, earn an additional 200,000 miles after spending $200,000 in the first six months. $395 annual fee.

- Capital One Spark Miles for Business: Earn 50,000 bonus miles after spending $4,500 on purchases within the first three months from account opening. $0 introductory annual fee the first year, then $95.

- Capital One Spark Miles Select for Business: Earn 50,000 bonus miles after spending $4,500 on purchases within the first three months from account opening. No annual fee.

The information for the Capital One Spark Miles Select has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Should you transfer Capital One miles to airline and hotel partners?

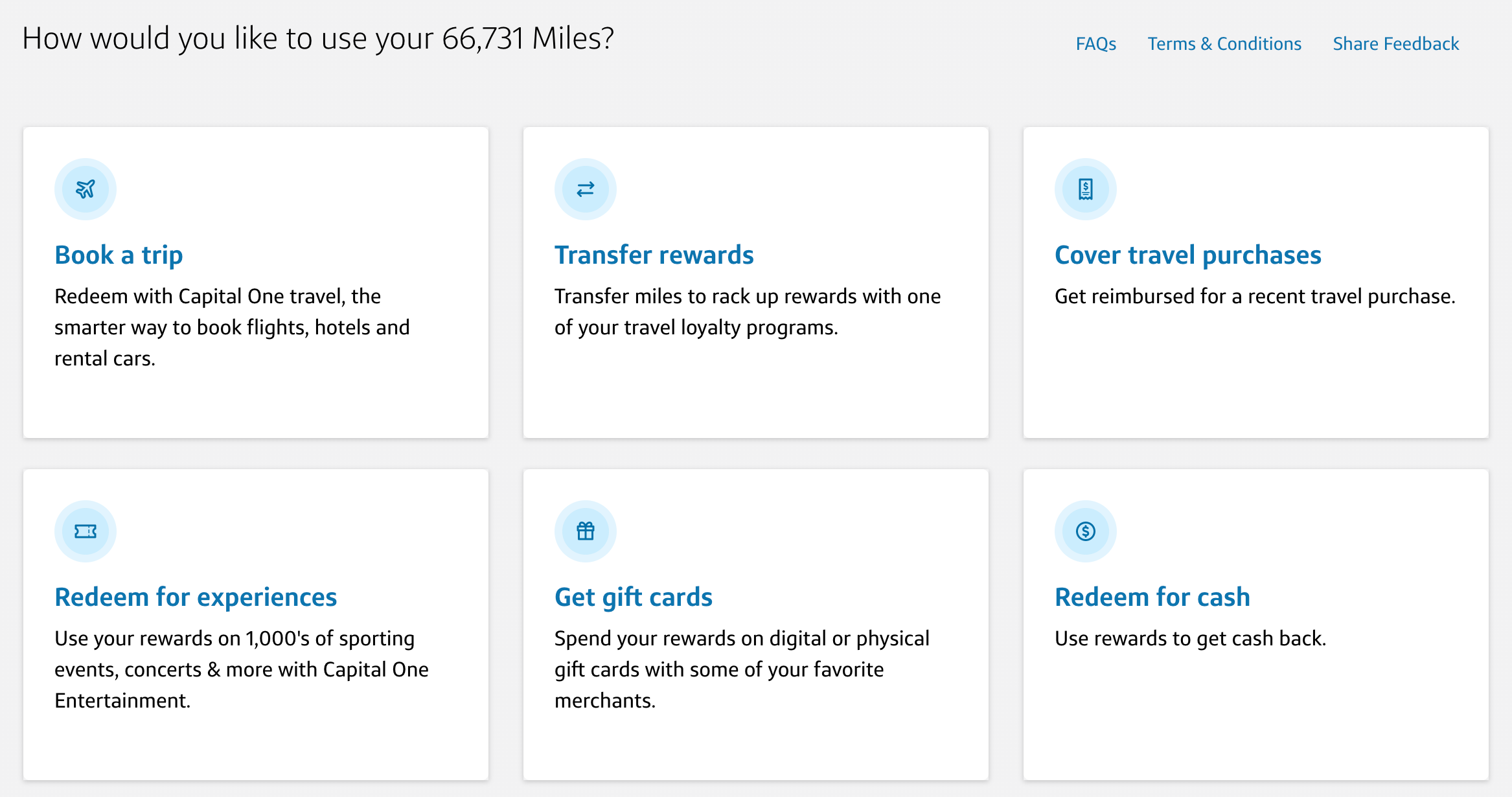

You have two options for redeeming your Capital One miles: for a fixed value at 1 cent each or by transferring them to airline and hotel partners.

If you aren’t in the mood to search for award availability, you’ve found a great cash deal or you can’t use airline miles or hotel points for your travel expenses, redeem your Capital One miles at a fixed value. The process is relatively easy and doesn’t require jumping through any hoops. Here’s a step-by-step guide to redeeming Capital One miles at a fixed value.

On the other hand, transferring miles and redeeming them for partner redemptions can get you a better value than 1 cent apiece. This is especially true when you transfer to a partner that has retained fixed award charts. You can fairly easily redeem 50,000 miles (for example) for something worth far more than $500.

If you’re interested in exploring this route, here’s how to transfer your Capital One miles to partners and book airline and hotel awards.

Related: How to decide when to use cash or miles for buying airline tickets

How to transfer Capital One miles to airline and hotel partners

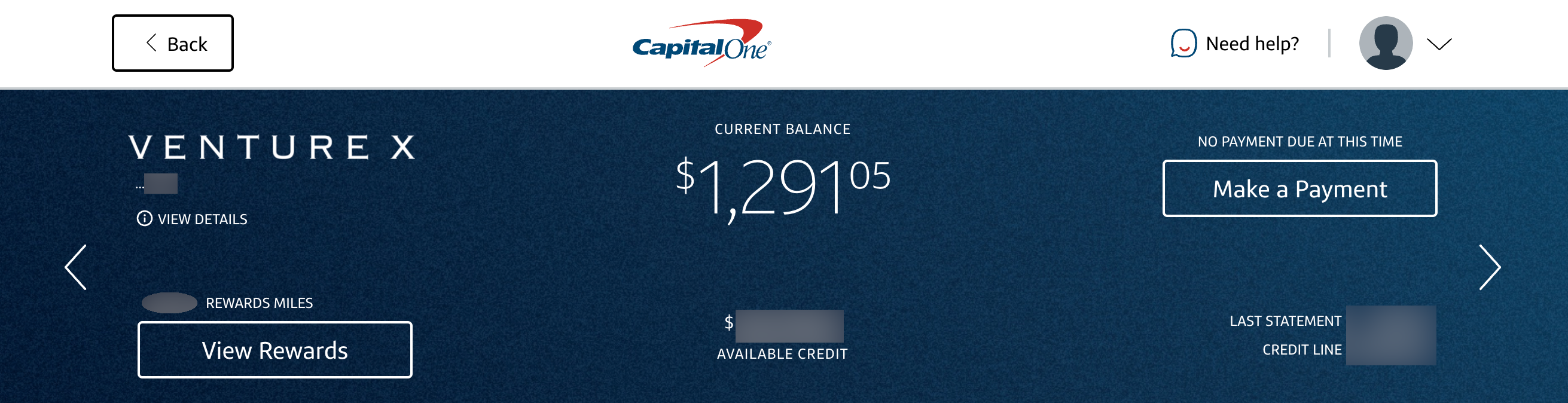

Using the issuer’s transfer partners can increase the value of your Capital One miles. Thankfully, the process is simple. First, head to Capital One’s website, log in and select your card. Then, click the “View Rewards” button.

From there, find the “Transfer Rewards” section.

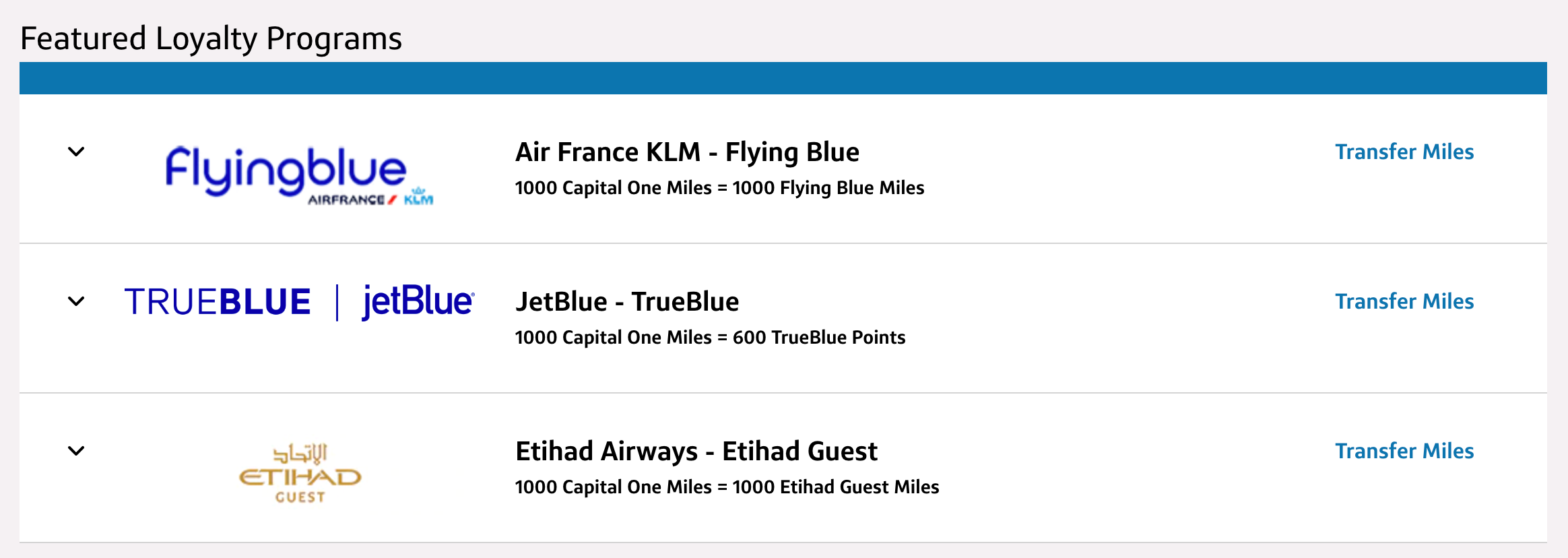

On the following page, you’ll see Capital One’s airline and hotel partners. Any transfer bonuses will appear in the “Featured Loyalty Programs” section at the top.

To start the transfer process, click “Transfer Miles” to the right of your desired airline or hotel partner. You’ll then be prompted to enter your loyalty number for that program and agree to the terms before choosing how many miles you want to transfer.

Once the transfer is complete, you’ll see a “Success!” pop-up message with a confirmation code you can save and/or print.

Related: Capital One re-adds JetBlue as transfer partner

Things to know before you transfer Capital One miles

Transfers are irreversible as soon as they’re complete, so be sure to enter the exact number of miles you want to transfer.

The minimum number of miles you can transfer is 1,000. Then, you can increase the amount in increments of 100. This is a nice feature that differs from other transferable points programs.

For example, transfers from Chase Ultimate Rewards must be in increments of 1,000 points. Capital One can thus be especially useful if you need to top off your account, though be sure to pay attention to the transfer ratios.

While Capital One miles transfer to most partners at a 1:1 ratio, a few partners — Accor, EVA Airways and JetBlue — have a less desirable ratio. You’ll see this information during the transfer process, so you’ll know how many points or miles you’ll receive in exchange for the designated number of Capital One miles.

Here’s a quick overview of Capital One’s transfer partners, their transfer ratios and transfer times:

| Program | Transfer ratio | Transfer time |

| Aeromexico Rewards | 1:1 | Instant |

| Air Canada Aeroplan | 1:1 | Instant |

| Air France-KLM Flying Blue | 1:1 | Instant |

| Accor Live Limitless | 2:1 | Two business days |

| Avianca LifeMiles | 1:1 | Instant |

| The British Airways Club | 1:1 | Instant |

| Cathay Pacific Asia Miles | 1:1 | 24-hours |

| Choice Privileges | 1:1 | 24-hours |

| Emirates Skywards | 1:1 | Instant |

| Etihad Guest | 1:1 | Instant |

| EVA Airways Infinity MileageLands | 2:1.5 | 36-hours |

| Finnair Plus | 1:1 | Instant |

| JetBlue TrueBlue | 5:3 | Instant |

| Turkish Airlines Miles&Smiles | 1:1 | Instant |

| Qantas Frequent Flyer | 1:1 | Instant |

| Singapore Airlines Krisflyer | 1:1 | Instant |

| TAP Air Portugal Miles&Go | 1:1 | Instant |

| Virgin Red | 1:1 | Instant |

| Wyndham Rewards | 1:1 | Instant |

Note: Transfer times may vary. Some TPG staff members have reported transfer times of up to two weeks for Accor.

Keep in mind that the name on your partner loyalty account must exactly match the name on your Capital One account — otherwise, you may not be able to transfer miles.

If you need to change your name, you’ll first need to update your name on one side. Keep in mind that this can slow down the transfer process. Having a brand-new loyalty account can also extend the time it takes to complete your transfer, which is why we recommend registering for loyalty programs well before you decide to make a transfer.

Transferring to partners can unlock a variety of valuable redemptions through the above airlines and hotels. TPG credit cards writer Augusta Stone recently transferred 15,000 Capital One miles to Air France-KLM Flying Blue to book two one-way domestic Delta Air Lines flights. This is a great example of how your Capital One miles can secure award flights on airlines it doesn’t directly partner with.

However, just because you can transfer Capital One miles to partners does not necessarily mean you should. We’ve collected some tips and tricks to get maximum value from your Capital One miles that should help you understand good and bad redemptions.

We always suggest researching flight and hotel availability before transferring your miles. Once the transfer is complete, you cannot reverse it.

Related: The best time to apply for these popular Capital One credit cards based on offer history

Capital One miles FAQ:

Which airlines can you transfer Capital One miles to?

You can transfer Capital One miles to 15 airline and three hotel loyalty programs. The full list is in the table above.

What is the transfer ratio for Capital One miles?

Most transfers process at a 1:1 ratio, with exceptions being Accor, EVA Air and JetBlue.

Do Capital One miles expire after transfer?

This depends on the loyalty program you transfer your points to. Rewards with some partner loyalty programs — for example, JetBlue TrueBlue — don’t expire. Meanwhile, points and miles transferred to other programs may expire after 12, 24 or 36 months of inactivity.

Is it worth it to transfer Capital One miles?

Transferring Capital One miles to partners is often worthwhile, as it allows you to earn more than 1 cent per mile from your rewards. That said, it can be more time-consuming since you have to learn the partner’s award chart and find award space.

Are there fees associated with transferring Capital One miles?

No, Capital One does not charge you to transfer miles.

How long does it usually take?

Most transfers process instantly, though some can take up to two days. See the table above for more information, but remember that transfer times may vary from person to person.

Can my Capital One miles be transferred back to my account if I change my mind?

No, transfers are final once initiated.

Bottom line

The ability to transfer Capital One miles to many valuable partner programs, paired with the always-available option to use your rewards directly, makes for a solid lineup of Capital One credit cards. That’s why we value Capital One miles at 1.85 cents apiece per our May 2025 valuations.

The fact that both the Venture Rewards and Venture X cards feature generous welcome bonuses can help you quickly amass these valuable miles for your next trip.

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)